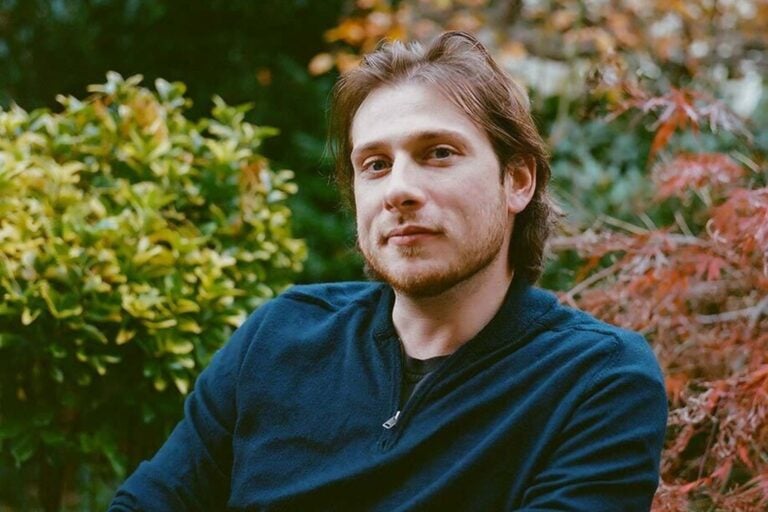

As the world continues its pivot towards electric vehicles (EVs), the question of charging infrastructure becomes increasingly crucial. EO Charging, a UK-based company dedicated to providing comprehensive charging solutions for EV fleets, has been at the forefront of this transition since 2014. In a candid interview with The EV Report, Charlie Jardine, CEO of EO Charging, sheds light on the company’s journey and offers insights into the EV market today and for the future. He discusses challenges, opportunities and the much-anticipated US expansion of EO Charging, providing an intriguing glimpse into the dynamic world of EV charging.

Do you mind sharing a brief overview of EO Charging?

EO Charging was founded in 2014, and provides turnkey EV charging solutions to fleets such as vans, trucks, and buses. We have our own engineering team to develop our software platform and some of the hardware in-house.

We deliver everything including design, construction, hardware, software, ongoing service, and maintenance. In Europe, we’ve been operating infrastructure for companies like Amazon, DHL, UPS, and supermarkets like Tesco, Sainsbury’s and Ocado over the past few years. We also assist bus operators such as Go Ahead Group and Stagecoach in the UK.

We’re based in the UK, but deliver for customers across nine countries in Europe and are in the process of expanding to North America.

Can you share some things you’ve learned while building the company?

When I left university, I went to work for a company that made charging stations. After 18 months I embarked on my own venture which became EO Charging. While I had some understanding of business, every step has been a learning curve. With a constantly changing market, the business has grown pretty dynamically.

In the beginning, much like any new business owner, it was a case of taking each step and challenge as it came. More recently, the global landscape for securing funds for companies like ours has definitely been challenging. We looked at an IPO on the NASDAQ in 2021 and then again in 2022, but eventually decided our plans had to change given the investment landscape.

Planning to take a business public and then changing direction certainly comes with its share of challenges. However, we managed to effectively secure funding in March this year, so we’re in a good place and in a good position to deal with both the opportunities and challenges that lie ahead.

What are your thoughts on the current state of the EV market?

I think, at the macro level, it’s great and going in the right direction today. There have definitely been issues around the supply chain, both on the vehicle side and also on the charging infrastructure side.

Within our realm, there’s certainly been a lull in supply on the car and the van side. On the bus side, however, it has been completely different. The bus market’s growing massively, with a perfect storm of vehicle supply and legislation forcing operators to decarbonize their fleets, particularly in towns and cities.

You also have a tremendous amount of subsidy. In the UK, Europe, and North America, the amount of government funding to support the transition of the public transportation system is enormous. For us, the bus side of our business has grown strongly in the last 12 months.

What are some of the challenges and opportunities that you see right now in EV Charging?

The traditional challenges like supply chain are certainly evident, of course, but the more substantial obstacle lies in establishing the necessary groundwork. Adapting fleet operations to accommodate EVs represents a seismic shift—one that demands an entirely new approach.

Suddenly, there’s a need to set up refueling infrastructure, manage energy consumption, and even upgrade power supplies— so many considerations that come hand in hand with deploying the charging infrastructure essential for recharging your new electric fleet. Needless to say, this is hugely time-consuming and comes with substantial financial costs.

It’s a new skill for almost every single operator, and I think that it is a real sticking point when it comes to moving forward at pace. Clearly, that’s why we’re here, and it’s why we do what we do. We’re here to help customers find the best way to electrify their fleet.

Do you think we will be able to catch up to the infrastructure needed for electrification?

I think our experience would say the vehicles and the infrastructure aren’t actually holding back the electrification. It’s a very good excuse, but it’s not the case. In fact, it’s safe to say that the growth of infrastructure is growing closely in line with the adoption of vehicles, but it does depend on the context.

The majority of charging happens either at homes or at the workplace. If you’re driving a car, home charging is pretty straightforward to get installed and quite cost effective. Given most people live in places with a driveway, charging your EV at home becomes quite easy.

Workplace charging is easy to deploy and use. I think on our side, vans, trucks, and buses typically have a one-for-one ratio, so every vehicle needs a charger. But you’re only going to buy the vehicles when you know you’ve got certainty around the investment to deploy the infrastructure. There might be a timing issue, but it’s going to happen.

The main area of concern is generally the public charging infrastructure. It’s largely a case of a lack of quality, over a lack of quantity. If you’re an EV driver using the public network, your biggest concern will be around its reliability.

EO Charging recently expanded into the US. What is your expectation for this market?

We’re based in the UK, with a smaller population and a small vehicle fleet relative to North America, and so the size of the market opportunity is a large factor. But the amount of money that the central government has been committing to electrifying the vehicle fleet in the US is unprecedented and far more than the level of funding we have over here. So while the US is behind the UK on EVs now, in three years I predict it will quickly catch up and take over. If you think about just the commercial opportunity, the subsidy brings an exciting opportunity for operators like us.

That’s also to be said on the vehicle side as well. With incentives comes better margins for OEMs. And I think you’ll hear of rumours that OEMs are diverting a lot of their supply to the US market for that reason.

What’s particularly interesting about focusing on van, truck and bus fleets is, at least today, the amount of money going towards helping buses electrify, whether it’s public transit buses or school buses, is making operators move really quickly. The size of the vehicle fleet in the US is much bigger – you’ve got almost 600,000 school buses and transit buses versus just 40,000 transit buses in the UK.

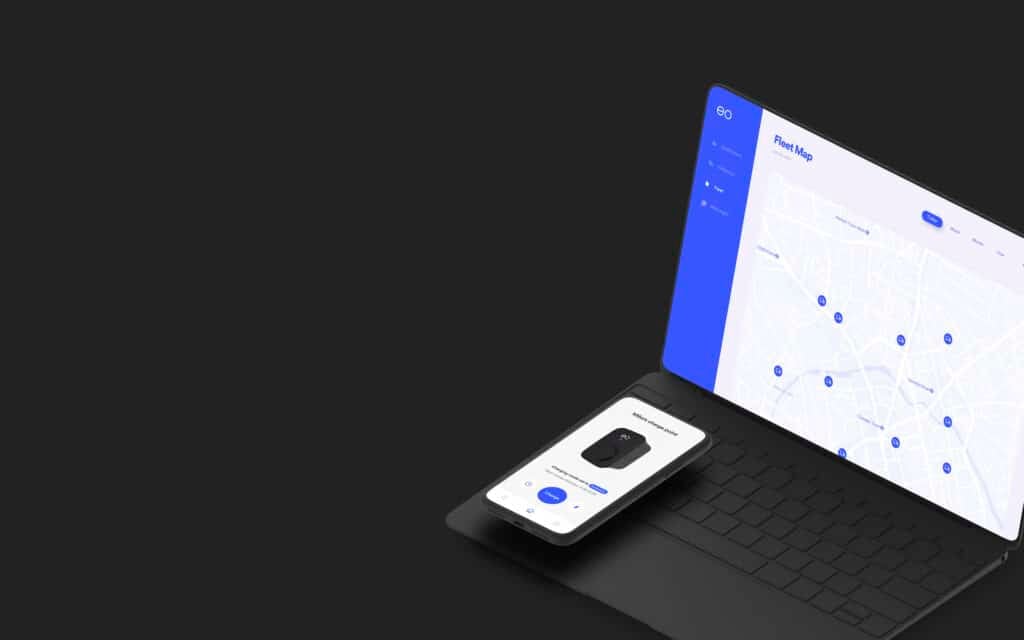

So the market is significantly bigger. And the proposition that we’ve developed, particularly on the software side, is the 99% uptime that we guarantee for our operators. That is being unbelievably well received by customers in the US market, who’ve not had that level of experience before.

Are there any unique challenges or differences in the US versus the UK?

I think one area is the speed of getting infrastructure in the ground. We have a pretty regulated, mature system when it comes to applying for and getting grid upgrades here in the UK. The process across the US seems pretty fragmented. The length of time it takes to get a new grid connection in the US can be significantly longer than in the UK. I think generally, though, the American appetite to do things quickly at scale is super exciting and will overcome a lot of obstacles.

EO Charging has built relationships with large global brands already. Do you see this as an advantage as you enter the US market?

Yes, take Amazon for example. We have nearly 6,000 charges in 115 depots across nine European countries, with infrastructure operating at above 99.6% uptime. Tell that story to any US fleet, whether it’s a van, truck, or bus, and they are floored. No one’s done that many sites for a single operator. So whether it’s for customers that don’t have a presence over here or it might be Amazon, DHL or UPS, everything we do here resonates with US operators. And so that’s really helping us as we enter the market.

Do you find that US customers have different demands or expectations than what you’ve seen from other countries?

I’d say it’s pretty similar, but we are seeing operators dealing with challenges our operators faced three to five years ago. You’ve made a commitment to go electric, you’ve bought the vehicles, and now they’re not working, or the infrastructure’s not working. Everyone’s pointing the finger at everyone else. Ultimately, the operator is focused on having an operational fleet. Seeing some of the key challenges that these guys are facing is definitely familiar. Outside of that, however, the market’s pretty similar. Operating a vehicle fleet is almost no different in the UK.

Fleet is your priority, but do you serve other segments, such as residential or multifamily units?

Fleet is our focus. We don’t do public charging infrastructure, but we do return fleets to their home. So if you look at someone like Verizon, whose employees drive vans, a lot of the drivers take the vehicles home back to their own driveway. So from an EO Charging standpoint, we are addressing a fleet issue. That could be charging at home, in the depot, or en route. Our focus is very much within the depot, the workplace or the home. The point of doing all of that is to have the customer use one single software platform that allows them to monitor, manage and monetize or reimburse their employees’ charging.

What’s your vision for EO Charging over the next five to 10 years?

I think the electrification of the global fleet is just starting. While Europe’s a little more ahead of the US, they’re all in pretty early stages, relative to the opportunity. So for us, the next 10 years are about trying to become the global leader in charging van, truck, and bus fleets in the depot. Clearly, starting with charging as that’s our focus.

We‘d also like to extend our services into other things such as battery storage, solar and financing infrastructure. At the moment, we install the majority of our projects, so design, construct, supply the hardware and then onboard those assets to our software and service platform to get paid upfront. But going forward we’ll look to finance the infrastructure too.

Click HERE to learn more about EO Charging.