What’s Happening

NIO, the global electric vehicle (EV) company, has allied with Qover and Helvetia International Automotive to unveil a unique embedded motor insurance product named InsureMyNIO. Specifically crafted for NIO users in Germany and the Netherlands, this innovative solution is integrated directly into the vehicle purchasing process, allowing seamless insurance coverage for customers.

Why It Matters

The partnership is emblematic of the evolution within the insurance industry, pushing towards digitization and customized service offerings. Through InsureMyNIO, customers can activate their policy within a minute via an easy online registration process. The insurance coverage is comprehensive, taking into account vehicle damage, personal injury, and third-party liability. This represents a significant enhancement to the electric vehicle ownership experience, eliminating the need to obtain a quote or converse with an agent.

Key Points

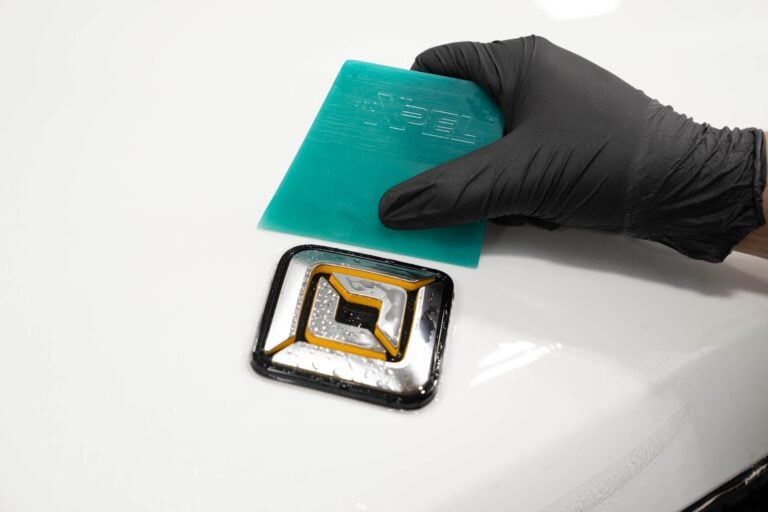

The InsureMyNIO solution is designed to be user-centric and aims to accommodate users’ needs, offering tailored insurance products approved by NIO. The embedded insurance product can be integrated at any point during the user journey, enhancing the digital experience of owning a NIO vehicle. Quentin Colmant, CEO and Co-founder of Qover, cites NIO’s groundbreaking battery swap technology as an ideal match with Qover’s innovative approach towards insurance solutions. The policy is underwritten by international insurance firm, Helvetia Global Solutions, further strengthening the robustness of the program.

Bottom Line

The launch of InsureMyNIO underscores the commitment of NIO, Qover, and Helvetia to enhancing user experience by leveraging digital solutions and industry expertise. This collaboration promises to swiftly and efficiently address insurance needs of electric vehicle users, setting a new benchmark for convenience and ease in the rapidly evolving automotive insurance sector.