Los Angeles CA – Indiev, Inc. (“INDIEV”), an electronic vehicle company specializing in the design of next-generation electric vehicles, and Malacca Straits Acquisition Company Limited (Nasdaq: MLAC) (“Malacca”), a special purpose acquisition company (SPAC), today announced they have entered into a definitive merger agreement for a business combination that will result in INDIEV becoming a wholly-owned subsidiary of Malacca.

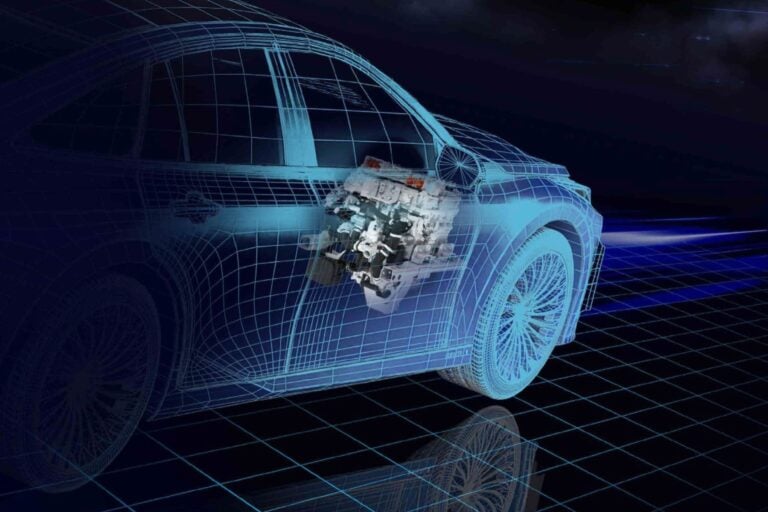

INDIEV was founded in 2017 on the idea that the future of personal mobility will no longer be defined solely by horsepower or top speed, but rather from the connectivity, customizability, and processing power offered to drivers and passengers. Currently, the gap between the level of computing power available to individuals on their phones and at home compared to their personal vehicles is astronomical.

Under the terms of the merger agreement, INDIEV will merge with a wholly-owned subsidiary of Malacca and the holders of the outstanding INDIEV shares will receive shares in Malacca valued at $600 million (subject to adjustments). In addition, the holders of INDIEV shares will be eligible to earn up to an additional 20,000,000 shares (approximately $200 million at current prices) on the achievement of performance milestones related to the price of the combined company’s common stock for the period starting 150 days after the closing until December 31, 2024 and vehicle sales targets for the first and second full years following closing.

Concurrently with the signing of the Merger Agreement, Mr. Hai Shi, founder and Chief Executive Officer of INDIEV has signed a subscription agreement to purchase $15 million of shares in Malacca at a price of $10.00 per share (the “PIPE Transaction”).

“This transaction marks a significant milestone for INDI, expanding financial and strategic opportunities as we transition from design to manufacturing of our INDI One,” said Mr. Hai Shi, Chief Executive Officer of INDIEV. “I would like to thank the entire INDI team for bringing us to this milestone, and Malacca for providing this opportunity to write the next chapter of INDI’s story.”

“We are impressed not only with INDI’s unique automotive designs and its vision, but with the level of development that they have achieved and the efficiency with which they have deployed capital,” said Mr. Gordon Lo, Chief Executive Officer of Malacca. “We see this acquisition as a significant value driver for our shareholders.”

INDIEV’s executive officers, including Mr. Shi, will lead the combined company. Prior to closing INDIEV is expected to appoint a board of directors of five individuals, which will meet all corporate governance requirements for continued listing on the Nasdaq Capital Market, including a majority of independent directors, and any required California state diversity requirements.

The Boards of Directors of both INDIEV and Malacca have unanimously approved the proposed merger, which is subject to customary closing conditions, including receipt of all regulatory approvals, approval of the proposed merger by INDIEV and Malacca’s shareholders, and approval for listing of the combined company’s shares on the Nasdaq Capital Market.

The closing under the merger agreement and the PIPE transaction is anticipated to occur in the first quarter of 2023, with Malacca to domesticate from the Cayman Islands to a Delaware corporation prior to the closing. Malacca will be rebranded and operate as “INDI Electric Vehicles Inc.” and is expected to list on Nasdaq under the ticker symbol “INEV.”

Sheppard Mullin Richter & Hampton, LLP served as legal advisors to INDIEV. Ellenoff Grossman & Schole LLP served as legal advisors to Malacca. Maples Group acted as Cayman Islands counsel to Malacca.